INTRODUCTION

Discover the top dividend yielding stocks India in 2024, featuring companies offering the highest dividend payouts. Explore the maximum dividend-paying stocks in India for consistent income and long-term growth.

Investors in the Indian stock market often seek opportunities to maximize returns, and one way to achieve this is through dividend-paying stocks. Dividend stocks are preferred by both conservative investors seeking steady income and growth-oriented investors looking for a mix of capital appreciation and dividend income. In this blog, we’ll explore the top dividend yielding stocks India in 2024, including companies that consistently offer the highest dividend yields. Whether you are new to investing or a seasoned market player, dividend stocks should be a part of your portfolio to enjoy regular income in addition to capital gains.

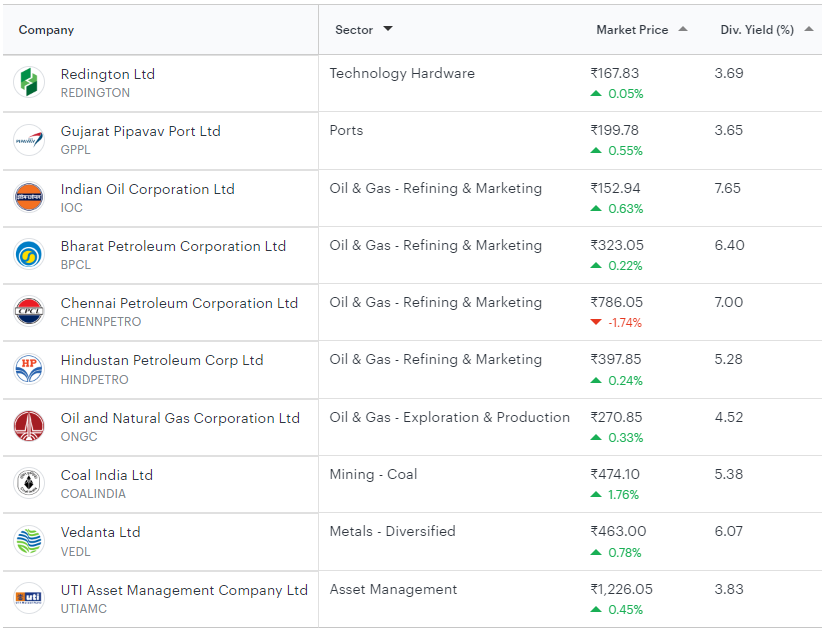

Highest Dividend Paying Stocks in 2024 from Nifty 500

Here are the top 10 dividend paying stocks in India from Nifty 500:

Disclaimer: Please note that the above list is for educational purposes only, and is not recommendatory. Please do your own research or consult your financial advisor before investing.

Note: The data in the list of top dividend paying stocks in India is subject to real-time updates.

- Stock Universe: Nifty 500

- Dividend Yield: Sorted from Highest to Lowest

🚀 Pro Tip: You can use Tickertape’s Mutual Fund Screener to research and evaluate funds with over 50+ pre-loaded filters and parameters.

* We are sharing this Image and data from smallcase.

What Are Dividend Yielding Stocks?

Dividend-yielding stocks are shares of companies that distribute a portion of their earnings as dividends to shareholders. The dividend yield is calculated by dividing the annual dividend per share by the stock’s current price, which gives an idea of how much return investors can expect in the form of dividends relative to their investment. High dividend paying stocks generally come from established companies with strong financials.

Why Invest in High Dividend Paying Stocks?

- Regular Income: For investors who prefer a steady income stream, high dividend paying stocks in India offer consistent returns in the form of dividends.

- Capital Preservation: These stocks tend to come from well-established companies that focus on capital preservation and steady growth.

- Compounding Power: Reinvesting dividends can lead to compounding returns over time, enhancing wealth generation.

- Inflation Hedge: Regular dividend payments can serve as a hedge against inflation by providing real-time income.

Top Dividend Yielding Stocks India for 2024

An overview of the 10 highest dividend paying stocks in India as of 2024, offering attractive yields for income-focused investors:

- Coal India

- Dividend Yield: ~9-10%

Coal India is a state-owned enterprise and the largest coal producer in the world. The company has consistently offered attractive dividends due to its dominant market position and cash flow generation. In 2024, Coal India is expected to remain one of the top dividend yielding stocks India.

- Dividend Yield: ~9-10%

- Indian Oil Corporation (IOC)

- Dividend Yield: ~8-9%

A major player in the oil and gas industry, Indian Oil Corporation (IOC) has been a consistent performer in paying out high dividends. The company benefits from its government backing and operational dominance in the oil sector, making it a strong choice for investors seeking high dividend income.

- Dividend Yield: ~8-9%

- NTPC Limited

- Dividend Yield: ~6-7%

One of India’s largest power companies, NTPC Limited has a reliable track record of high dividend paying stocks in India. The company’s focus on long-term projects in renewable energy, along with its traditional thermal power operations, ensures stable returns.

- Dividend Yield: ~6-7%

- Bajaj Auto

- Dividend Yield: ~5-6%

Bajaj Auto, a leader in the two-wheeler segment, has been rewarding its shareholders with consistent dividends. With strong cash reserves and impressive operational efficiency, Bajaj Auto continues to offer good returns to investors.

- Dividend Yield: ~5-6%

- Hindustan Zinc

- Dividend Yield: ~6-7%

A subsidiary of Vedanta, Hindustan Zinc has emerged as a consistent performer when it comes to dividends. The company benefits from its strong fundamentals and the demand for zinc in industrial sectors, making it one of the highest dividend paying stocks in India.

- Dividend Yield: ~6-7%

- Power Finance Corporation (PFC)

- Dividend Yield: ~7-8%

PFC is a leading financial institution in India’s power sector, known for its attractive dividend payments. With a focus on financing power projects, the company provides a steady income stream for investors.

- Dividend Yield: ~7-8%

- Rural Electrification Corporation (REC)

- Dividend Yield: ~8-9%

Similar to PFC, REC focuses on financing infrastructure projects in the power sector. The company’s consistent dividend policy has made it a popular pick for investors seeking maximum dividend paying stocks in India.

- Dividend Yield: ~8-9%

- Infosys

- Dividend Yield: ~4-5%

As a leading player in the IT services sector, Infosys not only offers capital appreciation but also rewards shareholders with regular dividends. The company has a strong global presence, making it a reliable choice for those looking for a blend of growth and income.

- Dividend Yield: ~4-5%

- Tata Consultancy Services (TCS)

- Dividend Yield: ~3-4%

Another IT giant, TCS is known for its robust financial performance and shareholder-friendly dividend policies. While its dividend yield is relatively lower compared to other sectors, TCS offers a combination of growth potential and dividends.

- Dividend Yield: ~3-4%

- GAIL (India) Ltd.

- Dividend Yield: ~6-7%

A leader in the natural gas sector, GAIL offers a steady dividend payout, making it an attractive choice for dividend-focused investors. The company has a diversified business model with stable cash flows.

- Dividend Yield: ~6-7%

Factors to Consider When Choosing Dividend Stocks

When evaluating high dividend paying stocks in India, investors should consider several factors:

- Dividend Yield: While the dividend yield is an important metric, it should not be the only criterion. A high dividend yield might indicate a stock that is undervalued, but it could also point to financial distress.

- Dividend Consistency: The history of dividend payments is crucial. Look for companies with a consistent track record of dividend payouts over several years, as this indicates financial stability and reliability.

- Payout Ratio: The payout ratio tells you what percentage of a company’s earnings is paid out as dividends. A very high payout ratio could signal that the company is prioritizing dividends over growth, while a very low payout ratio could mean the company is retaining earnings for future growth.

- Sectoral Strength: Some sectors like utilities, power, and oil and gas are known for steady dividend payments. Companies in these sectors tend to generate stable cash flows, which are crucial for paying regular dividends.

Maximum Dividend Paying Stocks in India: Key Takeaways

The Indian stock market offers a wide range of opportunities for dividend investors. Whether you are looking for steady income or long-term growth, the highest dividend paying stocks India can be a great addition to your portfolio. While some stocks like Coal India and NTPC are known for their high dividend yields, others like Infosys and TCS offer a balanced approach with both growth and income potential.

In 2024, investors should focus on selecting stocks from diverse sectors to minimize risks and maximize returns. Top dividend yielding stocks India are likely to come from the power, oil and gas, IT, and industrial sectors. By investing in companies with strong fundamentals and consistent dividend policies, you can achieve a well-rounded investment portfolio that not only provides regular income but also grows in value over time.

How to Invest in the Highest Dividend Paying Stocks India via smallcase?

Let’s us see a few steps that we can follow to get perspective in India top dividend paying stocks investing in high dividend paying stocks in India via smallcase:

1. Log in with any Indian smallcase broker and enter password on smallcase app or website.

2. Congrats! You have invested in high dividend paying stocks in India!

3. Explore smallcase like the Dividend smallcase by Windmill Capital or the DiviGrowth Capital smallcase managed by Green Portfolio to find out which suits your needs best. After designing your investment goals with a particular smallcase, make a choice.

4. Review your personal details and the billing plan before placing an order.

5. Next, click on ‘Invest now’.

6. Lastly, choose between Monthly SIP or One Time payment method for the highest dividend paying stocks India of your choosing.

7. Finally, click on ‘Confirm Orders’.

CONCLUSION

Dividend investing is an effective strategy for achieving financial goals, whether you are looking for income, growth, or a combination of both. In India, several companies offer attractive dividend yields, making them ideal candidates for income-focused investors. The top dividend yielding stocks India for 2024 present a mix of stability, profitability, and growth potential, ensuring that you can create a diversified portfolio that caters to your investment needs.

Invest wisely in these high dividend paying stocks in India to enjoy a consistent income stream and make the most out of the opportunities in the Indian stock market.

By ENQUIRE in a reputable ISMT Best Stock Market Course In India (Varanasi) provides both Online & Offline courses to gain knowledge and skills in the world of trading and investment.